Cynthia J. O'Hora

Mrs. O's House: Gas and Diesel Taxes

Students will evaluate whether federal tax on gas and diesel fuels should stay the same or increase based on data researched and write persuasive letters to their local papers and legislators urging them to take their stance.

Internal Revenue Service

Irs: Income Tax Facts

This lesson plan will help students understand that taxation involves a compromise of conflicting goals and that people who have the same income may not pay the same amount in taxes.

Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding Assessment

Answer the following multiple-choice and true/false questions about payroll taxes and federal income tax withholding by clicking on the correct answers. To assess your answers, click the Check My Answers button at the bottom of the page.

Internal Revenue Service

Irs: How Taxes Evolve? Lesson Plan

This lesson plan will help students understand that the legislative process of enacting federal income tax laws involves formal procedures based on the Constitution and informal procedures that blend and balance various interests.

Internal Revenue Service

Irs: Income Tax Issues Lesson Plan

This lesson plan will help students understand how and why a federal income tax was implemented by Congress during the Civil War and in 1913.

Other

Payroll taxes.com:federal Payroll Tax Forms and Filing Addresses

This site explains the purpose of the W-2 form, special situations that affect it, and where and when to file it.

Internal Revenue Service

Understanding Taxes: The Social Security Act of 1935

This very complete lesson plan explains the history of the Social Security Act of 1935, its history and importance to the elderly during the Great Depression, and its importance today. Everything necessary to teach the lesson and assess...

Internal Revenue Service

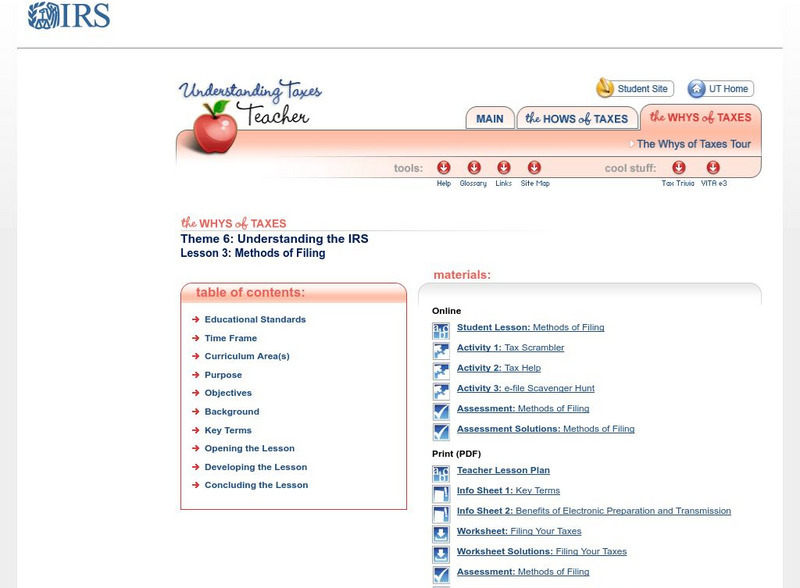

Irs: Methods of Filing Lesson Plan

This lesson plan will help students understand the methods of filing tax returns and the advantages of preparing and transmitting tax returns electronically.

Other

Ss Bulletin: Constitutional Background to the Social Security Act of 1935 [Pdf]

A very interesting discussion of the potential problems that plagued the implementation of the Social Security Act. Read about the cases brought before the Supreme Court which gave Congress the constitutional ability to tax and spend for...

Independence Hall Association

American Government: Financing State and Local Government

Taxes are collected by federal, state, and local governments to pay for a wide variety of services. This article helps students understand where their tax money goes.

Cornell University

Cornell University: Law School: Unemployment Compensation Law

This page by the Legal Information Institute at Cornell University provides an overview of unemployment compensation law. Learn why unemployment law exists and what it guarantees.

![Ss Bulletin: Constitutional Background to the Social Security Act of 1935 [Pdf] Primary Ss Bulletin: Constitutional Background to the Social Security Act of 1935 [Pdf] Primary](https://static.lp.lexp.cloud/images/attachment_defaults/resource/large/FPO-knovation.png)