Curated OER

Module 12-Self-Employment Income and the Self-Employment Tax

Young scholars explain self-employment income and the self-employment tax. They distinguish between an employee and an independent contractor and explain how to compute and report self-employment profit.

Curated OER

The Wealth Tax of 1935 and the Victory Tax of 1942

Students explain that during the Great Depression and World War II, the Roosevelt administration implemented new, broader, and more progressive taxes in order to cover the costs of the New Deal programs and the war.

Curated OER

Methods of Filing

Learners explain the methods of filing tax returns and the advantages of preparing and transmitting tax returns electronically. They identify the return method that is most appropriate for certain taxpayers.

Curated OER

The IRS Yesterday and Today

Learners explain why the Internal Revenue Service was instituted, how it functions, how it has changed over the years, and the ways it helps taxpayers today.

Curated OER

Interest Income

Students identify taxable interest income, and report taxable and tax-exempt interest income.

Curated OER

Dependents

Students explain dependency exemption and how it affects taxable income, and apply the five dependency tests to determine whether a person can be claimed as a dependent.

Curated OER

Exemptions

Students explain how exemptions affect income that is subject to tax, and determine the number of exemptions to claim on a tax return.

Curated OER

Your First Job

Students determine that they are responsible for paying income taxes through withholdings on earned income. They examine the Form W-4.

Curated OER

"No Stamped Paper to Be Had"

Students examine primary documents pertaining to the Stamp Act to explain colonial objections to the expansion of taxes.

Curated OER

Income Tax Time Word Problems Lesson

Students investigate what taxes are and solve related problems.

Curated OER

Paying Taxes for Chores Lesson

Students examine the concept of paying taxes with a chores theme.

Curated OER

Regressive Taxes

Students explain that regressive taxes can have different effects on different income groups. They see how a regressive tax takes a larger share of income from low-income groups than from high-income groups.

Curated OER

Your Role as a Taxpayer: Why Pay Taxes?

Students evaluate the basic rationale, nature, and consequences fo taxes. They describe why governments need taxes as revenue to provide goods and servicesin this series of activities.

Curated OER

Taxes in U.S. History: Evolution of Taxation in the Constitution

Learners receive an overview of the role and purpose of taxes in American history. They identify different types of taxes implemented by the US government and explain the origin of the federal income tax.

Curated OER

Fairness in Taxes

Students identify and describe two criterion of tax fairness: benefits received and the ability to pay and distinguish between wealth and income as measures of ability to pay.

Curated OER

Leveled Problem Solving Discounts, Markups, Tips, and Sales Tax

In this discounts and sales tax instructional activity, students problem solve and work with discounts, markups, tips, and sales tax by completing the six word problems.

Curated OER

Family Purchases

Students generate a gift list for their family members making sure the costs remain under budget. They research the cost of items on the internet, calculate sales tax, and determine the total cost for all of the gifts.

Forum Romanum

Outlines of Roman History: Rome and the Provinces

Rome's great strength was her brilliance in governing. Read how she organized and governed her provinces. The "law of nations", ius gentium, evolved into consistent justice throughout Roman lands.

Forum Romanum

Outlines of Roman History: Times of Marius and Sulla: Rise of Marius

In this section of a chapter in William Morey's 1901 textbook, you will find out about Marius and his reorganization of the Roman army.

Internal Revenue Service

Irs: Why Pay Taxes? Lesson Plan

This lesson will help students understand the basic rationale, nature, and consequences of taxes.

Internal Revenue Service

Irs: Evolution of Taxation in the Constitution Lesson Plan

This lesson plan will give students an overview of the role and purpose of taxes in American history.

Internal Revenue Service

Irs: Taxes and a Market Economy Lesson Plan

This lesson plan will help students understand the role of taxes in the market economy.

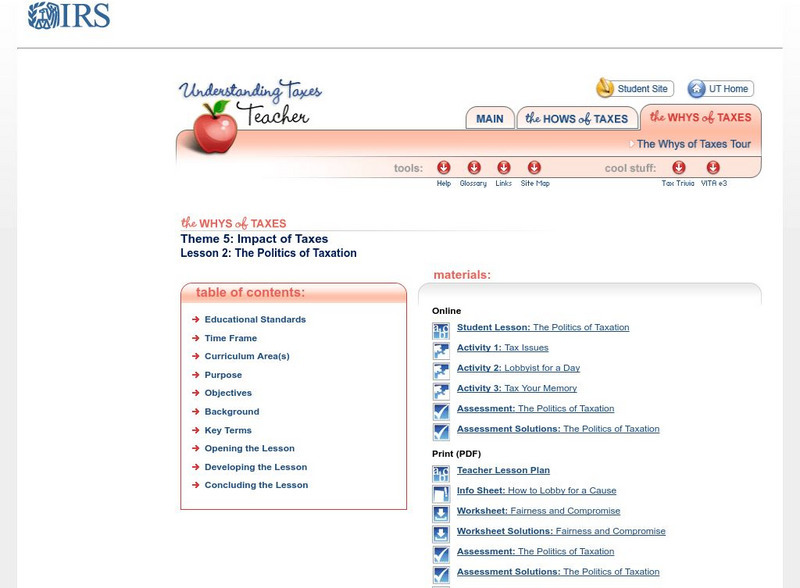

Internal Revenue Service

Irs: The Politics of Taxation Lesson Plan

This lesson plan will help students understand that taxation involves a compromise of conflicting goals and that lobbyists can influence lawmakers' decisions about taxes.

CNN

Cnn Money: Tax Guide

Information about taxes including paying taxes, filing a return, audits, tax planning.