Curated OER

International Trade, Part I, Protectionism

In this economics worksheet, students define economic terms related to international trade and diagram domestic trade problems.

Curated OER

The IRS Yesterday and Today

Learners explain why the Internal Revenue Service was instituted, how it functions, how it has changed over the years, and the ways it helps taxpayers today.

Curated OER

Dependents

Students explain dependency exemption and how it affects taxable income, and apply the five dependency tests to determine whether a person can be claimed as a dependent.

Curated OER

The Taxpayer's Rights

Students examine rights of taxpayers and procedures the IRS uses to process tax returns

Curated OER

Exemptions

Students explain how exemptions affect income that is subject to tax, and determine the number of exemptions to claim on a tax return.

Curated OER

Earned Income Credit

Pupils distinguish between tax deduction and tax credit, explain how the earned income credit affects the tax liability, apply requirements to claim the earned income credit, and describe factors that determine the amount of the earned...

Curated OER

Lesson Plan on Intellectual Property: Combating Piracy in China

Students determine how counterfeit goods undermine the economy. In this global issues lesson plan, students examine economic principles. Students discuss how international piracy and property rights undermine trade as they participate in...

Curated OER

A Look at Individual Federal Income Tax

Students investigate the concept of a personal federal income tax. They conduct research and participate in class discussion in order to deal some of the issues. They include why there is an individual income tax and how the money is...

Internal Revenue Service

Irs: The Irs Yesterday and Today Lesson Plan

This lesson plan will help students understand why the Internal Revenue Service was instituted, how it functions, how it has changed over the years, and the ways it helps taxpayers today.

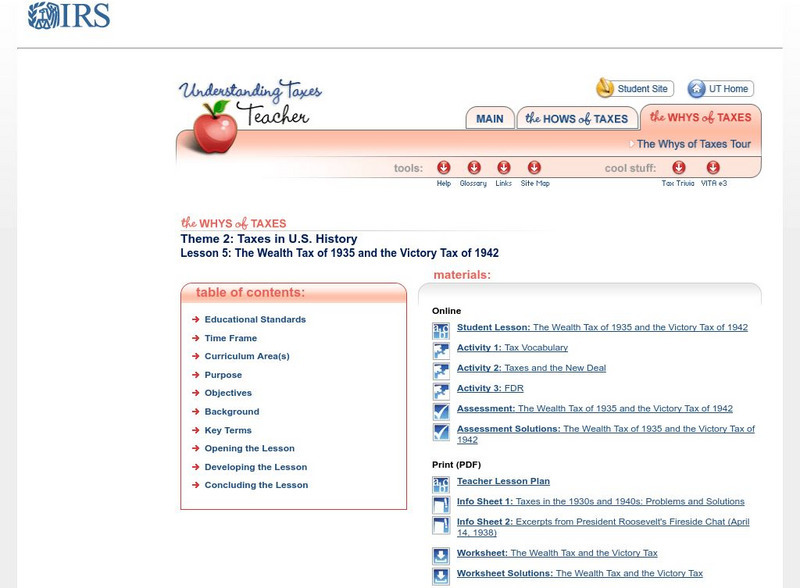

Internal Revenue Service

Understanding Taxes : The Wealth Tax of 1935 and the Victory Tax of 1942

This lesson plan from the Internal Revenue Service gives the history of the progressive income tax which helped fund the social programs implemented during the Great Depression, and the war effort after the country joined the Allies in...

Consumer Financial Protection Bureau

Consumer Financial Protection Bureau: Understanding Jobs, Teens, and Taxes

Students review Internal Revenue Service webpages and respond to questions to explore the relationship between working and taxes.